Soscredit Philippines Review — Fast Online Loans for Urgent Needs

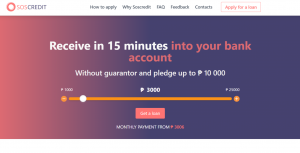

In times of financial stress, waiting days for a loan approval is not an option. Soscredit Philippines is a fast, convenient, and secure platform that connects Filipino borrowers with instant online loan offers — with no collateral, minimal requirements, and approval in just minutes.

Let’s take a closer look at how Soscredit works, its loan terms, and how it compares to other popular loan apps in the Philippines.

💼 What Is Soscredit?

Soscredit.ph is a loan matching service — also known as a loan aggregator — that helps you access multiple loan offers from trusted, licensed financial institutions. It doesn’t lend money directly, but instead connects you with lenders that match your profile.

With a clean, mobile-friendly design and a quick online form, Soscredit is ideal for first-time borrowers, freelancers, and anyone who needs emergency money without stress.

✅ Key Features and Benefits

-

✅ Instant matching with legit lenders

-

✅ Application takes less than 5 minutes

-

✅ No fees to use the service

-

✅ High approval rates

-

✅ No documents or payslips required

-

✅ Disbursement via GCash, Maya, or bank

-

✅ 24/7 access — apply anytime

Soscredit is the answer for Filipinos looking for online loans without collateral, long forms, or delays.

📲 How to Apply for a Soscredit Loan

-

Visit soscredit.ph

-

Choose the amount and loan duration you need

-

Fill in your basic info — name, mobile, email, job

-

Submit the form

-

Get matched with lenders in real time

-

Choose the offer you like and complete the application

-

Receive money to your GCash or bank account

You’ll typically receive 2–5 offers from trusted lending partners. The best part? You only apply once.

👤 Who Can Use Soscredit?

Soscredit is available to a wide range of borrowers:

-

Age: 18 to 70 years old

-

Filipino citizen with at least 1 valid ID

-

With a working phone number and email

-

Has a GCash, Maya, or bank account

-

No credit history required

-

Open to employed, self-employed, freelancers

If you’re new to online loans or have been rejected elsewhere — Soscredit increases your chances of approval by comparing offers for you.

💰 Loan Terms via Soscredit Partners

Since Soscredit connects you with lenders (and is not a lender itself), exact terms may vary. However, most offers follow these general conditions:

-

Loan Amount: PHP 1,000 to PHP 25,000

-

Loan Term: 61 to 180 days

-

Interest Rate: 0% for new borrowers, 12%–36% annual for others

-

Disbursement: GCash, Maya, or direct bank deposit

-

Processing Time: 10–30 minutes

-

Repayment: through wallet apps, banks, 7-Eleven, or remittance centers

💡 When Should You Use Soscredit?

Soscredit is perfect for:

-

Paying rent, bills, or groceries when your budget runs short

-

Emergency expenses like medical care or car repairs

-

First-time online loan users

-

People with no payslips, credit history, or bank statements

-

Freelancers, gig workers, online sellers

If you want to compare legit loan apps in one place, Soscredit is a safe starting point.

📉 What to Watch Out For

-

You still have to finish the application with the lender

-

Offers may vary in interest and processing fee

-

You may receive follow-up messages from lending partners

-

First-time loan amounts are often smaller (PHP 3,000–7,000)

But overall, it’s a free, secure, and time-saving tool to avoid the trial-and-error of applying to random apps.

🤝 Soscredit Compared to Other Loan Apps

Compared to Credy or Cashspace, Soscredit has a very similar model — it’s a loan aggregator that helps you browse pre-qualified options quickly. However, many users report that Soscredit’s interface is cleaner and easier to navigate on mobile.

Versus direct lenders like Finbro or Finmerkado, Soscredit offers more choice but requires you to complete your application elsewhere. Finbro might approve bigger loans faster if you already have history, but Soscredit helps first-timers find their best-fit lender.

When compared with Finapps or Cash-Express, Soscredit may not be as instant — but it provides multiple options, helping you pick the most affordable or flexible one.

In short:

-

Choose Soscredit for choice and ease of comparison

-

Choose Finbro or Finmerkado if you want direct processing

-

Choose Credy or Peroloan if you want a similar interface with more offers

-

Choose Finapps or Cash-Express if you need a 1-ID, lightning-fast GCash loan

Soscredit is a fast, smart, and free way to compare online loans in the Philippines. Instead of risking time with unknown apps, you get offers from real lenders — instantly. If you want peace of mind and quick money, start with Soscredit.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

Mira, 25, Quezon City

Super easy to use, I got 3 loan offers and picked one with the lowest interest.

Arvin, 37, Davao

Applied at night and still got approved next morning. Perfect for emergency bills.

Lianne, 30, Taguig

Didn’t know where to apply. Soscredit gave me legit options with no upfront fees.

Joshua, 28, Cebu

Used only one ID and didn’t need any documents. Money arrived same day.

Grace, 42, Makati

Love that they don’t charge you for matching. Got my loan in less than 2 hours.

Noel, 34, Pasig

Much easier than going to each loan site. Soscredit saved me time and effort.