PesoRedee Review — Fast Online Loans in the Philippines with Instant Approval

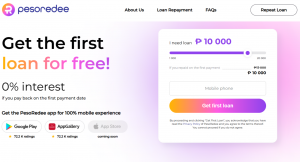

Are you searching for a legit loan app in the Philippines that offers fast approval, minimal requirements, and same-day cash? PesoRedee is one of the leading online loan providers helping Filipinos access emergency loans in just minutes — fully digital, no collateral, and with minimal paperwork.

In this review, we’ll explore how PesoRedee works, what sets it apart, and how you can apply for a fast cash loan online in the Philippines today.

💼 What Is PesoRedee?

PesoRedee Financing Co. Inc. is a registered lending company with the Securities and Exchange Commission (SEC) of the Philippines. Unlike illegal loan sharks or anonymous apps, PesoRedee is a licensed and legit provider of personal loans, known for fast approval and easy applications.

The platform serves as a loan app in the Philippines where users can apply online and receive funds without visiting any physical office.

⚡ Key Benefits of PesoRedee

If you need online loans in the Philippines, here’s why PesoRedee is worth considering:

-

✅ Loan approval in 5 minutes

-

✅ Loan disbursement the same day

-

✅ Minimal documents required

-

✅ First-time borrowers get special offers

-

✅ No collateral or guarantor needed

-

✅ Supports GCash, Maya, and bank payouts

-

✅ Available nationwide

PesoRedee is built for people who don’t have time for bank queues and want instant loan approval.

✅ Who Can Apply?

PesoRedee accepts a wide range of borrowers, making it ideal for:

-

Working Filipinos with or without payslips

-

Freelancers and gig economy workers

-

Self-employed individuals

-

First-time borrowers

-

People with bad credit history

-

Applicants without a credit score

Basic Requirements:

-

Filipino citizen

-

18 years old and above

-

Valid government-issued ID (UMID, Driver’s License, Passport, etc.)

-

Mobile number and email address

-

Personal bank account or e-wallet (GCash, Maya)

No credit card, ITR, or proof of billing is required.

📝 How to Apply for a PesoRedee Loan

Applying through PesoRedee is one of the fastest loan application processes in the Philippines.

-

Visit the official website: pesoredee.ph

-

Click “Apply Now” and enter your desired loan amount and repayment term

-

Fill out your name, ID number, contact details, and employment type

-

Upload your valid ID

-

Submit the form and wait for approval (within 5 minutes)

-

Once approved, receive money in your GCash, Maya, or bank account

The entire process takes under 10 minutes. Funds are usually disbursed within 1 to 3 hours.

💳 Loan Terms and Sample Offers

PesoRedee typically offers:

-

Loan amounts: PHP 1,000 to PHP 30,000

-

Loan terms: from 91 to 180 days

-

Interest rates: 0% for first-time borrowers, up to 11.9% monthly for repeat clients

-

Disbursement: GCash, Maya, bank transfer

-

No upfront fees

💡 For example: If you borrow PHP 5,000 for 91 days, your total repayment could be around PHP 5,500–5,900 depending on terms.

📲 Why PesoRedee Is One of the Most Trusted Loan Apps in the Philippines

Speed

PesoRedee is known for its 5-minute approval system — one of the fastest among legit providers.

Flexibility

Whether you’re employed, freelance, or working online, you can apply without formal documents.

Accessibility

Even borrowers with low credit scores or no borrowing history can get approved.

Transparency

No hidden fees. Loan terms are shown clearly before you confirm anything.

📊 What Can You Use PesoRedee Loans For?

-

💡 Emergency expenses — medical bills, appliance repairs, sudden travel

-

🏠 Utility payments — electricity, water, internet bills

-

📚 Education — tuition fees, school projects

-

💼 Business capital — supplies, equipment, restocking

-

💳 Debt consolidation — paying off more expensive loans

PesoRedee is ideal for short-term cash needs, bridging your finances until the next paycheck or solving urgent problems.

📈 Pros and Cons of PesoRedee

✔ Pros:

-

Instant approval (5 minutes)

-

No collateral or guarantor needed

-

Loan disbursed within the day

-

Open to borrowers with bad credit

-

Available nationwide

-

Transparent and secure

✖ Cons:

-

Not available for foreigners

-

Interest may be higher for second-time borrowers

-

Loan amounts for first-timers may be small (PHP 2,000–5,000)

🟢 Final Verdict: Is PesoRedee Worth It?

If you’re in the market for quick loans in the Philippines, PesoRedee offers speed, simplicity, and legit approval from a licensed lender. It’s ideal for:

-

Emergency financial situations

-

First-time borrowers

-

Freelancers and gig workers

-

People with no credit history

-

Anyone needing cash loans with instant disbursement

With 0% interest promos, fast approval, and minimal paperwork, PesoRedee continues to stand out in the crowded landscape of Philippine loan apps.

Borrow smart. Borrow safe. Borrow PesoRedee.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

“PesoRedee was the fastest loan I’ve ever applied for. Approved in 3 minutes, money in my Maya account within the hour.”

— Miguel, 28, Cavite

“They didn’t ask for anything except my ID and bank account. Very helpful when I needed cash urgently.”

— Joanne, 32, Quezon City

“I have bad credit and was rejected by other loan apps. PesoRedee still gave me a chance.”

— Roland, 40, Laguna

“No hidden fees. I knew exactly how much I had to repay. Good for responsible borrowers.”

— Andrea, 35, Taguig

“Perfect for emergencies and very user-friendly.”

— Jen, 30, Manila