LoanOnline Philippines Review — Get Online Loans Instantly Without Hassle

Need urgent cash? Want to avoid long bank lines and paperwork? LoanOnline Philippines is a modern solution for Filipinos seeking online loans with fast approval and zero stress. Whether you have bad credit or no prior borrowing history, LoanOnline connects you with legit lenders ready to help — even within minutes.

In this review, we’ll explore how LoanOnline works, how to apply, and why it’s considered one of the top loan platforms in the Philippines in 2025.

💼 What Is LoanOnline?

LoanOnline.ph is a loan comparison platform that connects Filipino borrowers with licensed lending companies. It doesn’t provide loans directly, but instead acts as a middleman between you and trusted lenders — helping you find the best offers based on your needs and eligibility.

This makes LoanOnline especially powerful for people looking for:

-

✅ Loan apps with fast approval

-

✅ Online loans without documents

-

✅ Loan offers for bad credit

-

✅ Multiple options in one place

LoanOnline works 100% digitally, from any device, and is completely free to use.

✅ Key Benefits of Using LoanOnline

-

Quick online application — under 5 minutes

-

Instant matching with multiple lenders

-

No fees to apply or compare offers

-

Supports borrowers with no credit history

-

Works even with one valid ID

-

Get funds via GCash, bank transfer, or e-wallet

-

Loans available even with bad credit

LoanOnline is ideal for those who want to avoid time-consuming application processes and get straight to the best loan deals in the country.

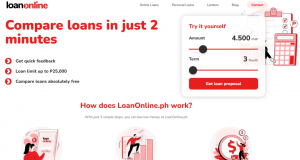

📲 How Does LoanOnline Work?

The process is simple:

-

Go to loanonline.ph

-

Choose your desired loan amount and repayment period

-

Fill out a brief application form

-

Submit the form and receive a list of personalized loan offers

-

Choose your preferred lender and complete the application on their website

-

Get the money directly to your GCash, Maya, or bank account

No phone calls. No physical documents. Just a simple online application and fast results.

📋 Who Can Apply for a Loan via LoanOnline?

LoanOnline is accessible to most Filipinos:

-

Age: 18–70 years old

-

Citizenship: Filipino

-

Employment: any (including freelancers and informal work)

-

Documents: at least 1 valid government-issued ID

-

Contact: active mobile number and email

-

Disbursement: must have GCash, Maya, or bank account

Even those with bad credit or no borrowing history are eligible to use LoanOnline and get matched with flexible lenders.

💡 Ideal Use Cases

LoanOnline is perfect for:

-

Emergency medical expenses

-

Paying utility bills before disconnection

-

School fees and tuition

-

Sudden car or home repairs

-

Business restocking or cash flow

-

Debt consolidation

If you’re looking for fast cash loans in the Philippines, this platform can save you time and money.

💰 Typical Loan Features Through LoanOnline

Since LoanOnline is a matching platform, exact loan features depend on the lender you choose. However, most partners offer:

-

Loan amounts: PHP 1,000 – PHP 25,000

-

Loan terms: 61 – 180 days

-

Interest rates: as low as 0% for first-time borrowers, up to 36% APR

-

Disbursement: GCash, Maya, or bank transfer

-

Approval time: as fast as 10 minutes

-

Requirements: 1 ID and active contact info

Some lenders even offer instant loan approval without any document uploads.

📈 Pros and Cons of LoanOnline

✅ Pros:

-

100% free to use

-

Easy, mobile-friendly platform

-

Fast results from multiple legit lenders

-

Accepts low credit score applicants

-

GCash and bank-friendly

-

Some 0% interest promos available

❌ Cons:

-

Not a direct lender — you’ll complete the loan process with a third party

-

You may receive promotional calls or SMS from lenders

-

Loan terms and approval vary depending on the selected partner

🔒 Is LoanOnline Legit?

Yes. LoanOnline Philippines is a legal, registered comparison platform, not a scam. It doesn’t issue loans or store your financial data. Instead, it helps borrowers safely connect with SEC-licensed lenders in the Philippines.

It’s a trusted tool to filter through shady apps and only deal with reputable, transparent options.

🔄 How Fast Is LoanOnline?

The entire process — from filling out your info to choosing a lender — can take less than 5 minutes. Once you select a lender and complete their form, funds may be disbursed within the same day, often in under 1 hour.

This makes LoanOnline an excellent solution for emergency loans or last-minute cash needs.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

Jen, 30, Quezon City

I used LoanOnline and within 3 minutes I had 4 lenders to choose from. Applied to one and got approved in 20 minutes.

Albert, 45, Cebu

I didn’t know which loan app to trust. LoanOnline showed me legit options only. Very helpful.

Rina, 27, Davao

My credit is poor but I still got an offer with zero upfront fees. Highly recommend this service.

Kyle, 34, Manila

Perfect if you’re in a hurry and don’t want to waste time applying one-by-one.

Arlene, 38, Makati

Simple, fast, and free. Got the money in my bank within the same day.