Kviku Philippines Review — Online Loans with Instant Approval and No Collateral

Looking for online loans in the Philippines that don’t require a payslip or collateral? Need urgent cash but don’t want to go through the tedious process of banks? Kviku Philippines might be the loan app you’re looking for — offering fast, easy, and fully digital loans to Filipino borrowers with minimal requirements.

In this review, we’ll dive into how Kviku works, its pros and cons, how fast the approval process is, and why it’s gaining popularity among people looking for fast cash loans.

💼 What Is Kviku?

Kviku Lending Co. Inc. is a legit online loan provider operating in the Philippines since 2020. The company is registered with the SEC (Company Registration No. CS202003056, Certificate of Authority No. 3264), and it is part of the international Kviku Group, which also operates in Russia, Kazakhstan, Poland, Spain, and other countries.

Unlike traditional banks, Kviku provides personal loans online without the need for face-to-face meetings, paperwork, or collateral. It caters especially to those who need emergency loans, loan apps without documents, or short-term financial solutions.

✅ Who Can Use Kviku?

Kviku is open to a wide range of borrowers in the Philippines, including:

-

Employed individuals (private or public sector)

-

Freelancers and gig workers

-

Self-employed professionals

-

OFWs (with local addresses)

-

Borrowers with no credit history

-

Individuals with bad credit looking for second chances

Kviku is often considered one of the best loan apps for bad credit in the Philippines.

⚡ Benefits of Using Kviku Loan App

-

✅ Fully online — no physical documents, no office visits

-

✅ Fast approval — within 15–30 minutes

-

✅ No collateral required

-

✅ Flexible loan terms up to 180 days

-

✅ Initial loan approval from PHP 1,000 to PHP 25,000

-

✅ Repeat borrowers can access higher amounts

-

✅ Disbursement via bank account or e-wallet

-

✅ Available 24/7 — apply anytime

Kviku is ideal for users who want a no-fuss loan solution that works with a mobile device and ID only.

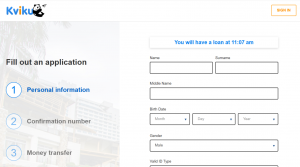

📝 How to Apply for a Kviku Loan

Here’s a step-by-step guide to applying for a Kviku online loan:

-

Visit kviku.ph

-

Choose your loan amount and repayment term

-

Fill in your full name, mobile number, and email

-

Upload a clear photo of your valid ID

-

Provide employment info and bank/e-wallet details

-

Submit and wait for SMS or email confirmation

-

Receive funds within 30–60 minutes

No face-to-face interaction. The entire process is done on your smartphone or computer.

📲 What Makes Kviku Different from Other Loan Apps?

Unlike most loan apps in the Philippines, Kviku is not just a small local startup — it’s part of a global fintech network. Here’s what sets it apart:

-

Proprietary AI system that processes applications automatically

-

Low rejection rate for first-time users

-

High approval rate even with low credit score

-

No phone calls or interviews required

-

Simple repayment system via bank transfer or GCash

💳 Loan Terms and Conditions

Kviku offers relatively flexible terms for a short-term loan provider.

-

Loan amount: PHP 1,000 – PHP 25,000 (can increase over time)

-

Loan term: 60 – 180 days

-

Interest rate: 0.16% per day (approx. 4.8% monthly)

-

Processing time: Same day (usually within 1 hour)

-

Disbursement: Bank account or GCash

-

Repayment: Bank transfer or GCash QR code

💡 Kviku does not currently support Maya or 7-Eleven for repayment, which is something to consider.

🔄 Repayment Options

Kviku offers flexible repayment methods through:

-

Bank deposit to BDO, BPI, Metrobank

-

GCash payment via QR code or manual input

-

Online banking

-

Mobile wallet transfers

Payments can be made in full or in part, depending on your contract. Failure to pay on time results in penalties, so it’s best to repay before the due date or request an extension in advance.

📊 When Should You Use Kviku?

Here are common scenarios when Kviku is a perfect solution:

-

Urgent medical needs

-

Utility disconnection notices

-

School expenses

-

Business capital

-

Emergency repairs

Whether you’re waiting for payday or handling an unplanned situation, Kviku can provide a fast and secure bridge loan with minimal friction.

🔐 Is Kviku Legit or a Scam?

Kviku Philippines is 100% legit and SEC-registered. They operate transparently and comply with all local financial laws. While some users online may complain about collection practices (like with most loan apps), the company adheres to data privacy and fair lending regulations.

Always read the full contract and only borrow what you can repay. But yes, Kviku is a safe loan app in the Philippines.

📈 Pros and Cons of Kviku Philippines

✅ Pros

-

No collateral or documents required

-

Very fast approval and disbursement

-

24/7 availability — apply anytime

-

Competitive interest rates

-

Part of an international fintech group

-

No phone calls or manual verification

❌ Cons

-

Limited repayment channels

-

No face-to-face assistance

-

Late payment penalties apply

-

Some users report aggressive reminders for overdue loans

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

Francis, 29, Pasig

Got approved for PHP 5,000 on my first try. Didn’t even upload payslip. Very smooth process.

Ellaine, 35, Davao

I used Kviku to pay my child’s tuition. The money was in my account within 45 minutes.

Jerome, 40, Quezon City

I like that there are no calls or awkward conversations. Just fill the form and get the money.

Liza, 31, Manila

Interest is decent compared to others. I paid early and they offered me more on my second loan.

Karl, 26, Cebu

If you need cash fast, this is one of the easiest loan apps in the Philippines. Just repay on time.