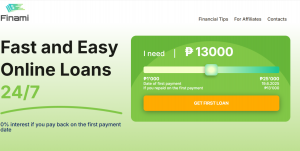

Finami Philippines Review — Simple Online Loans with Fast Approval and Flexible Terms

Looking for a fast and simple loan in the Philippines? Finami is a direct lender that provides online loans with instant approval, minimal requirements, and quick disbursement. Whether you need cash for an emergency, bills, or daily expenses, Finami allows you to borrow conveniently from your phone — no collateral, no long lines, no paperwork.

In this article, we’ll cover everything you need to know about Finami: how it works, who can apply, its loan terms, and how it compares with other popular loan apps in the Philippines.

💼 What Is Finami?

Finami Lending Inc. is a licensed online lending company operating in the Philippines under the regulation of the Securities and Exchange Commission (SEC). It specializes in offering short-term personal loans to Filipino citizens through a fully digital application process.

Finami is not a loan aggregator — it’s a direct lender, which means you apply directly through their platform, and they process and approve the loan themselves. This reduces delays and increases the chances of fast approval.

✅ Key Features and Benefits of Finami

-

✅ Fast approval — decisions in as little as 15 minutes

-

✅ Fully online — no need to visit a branch

-

✅ No collateral required

-

✅ GCash and bank transfer available

-

✅ Minimal documentation — just 1 valid ID

-

✅ High approval rate for new borrowers

-

✅ Easy-to-use mobile website

Finami is built for modern users — freelancers, employees, students, and first-time borrowers — who want cash quickly without going through the traditional banking process.

📲 How to Apply for a Finami Loan

-

Visit the official website: finami.ph

-

Choose your desired loan amount and term

-

Register with your mobile number

-

Fill in your personal and employment details

-

Upload one valid government-issued ID

-

Submit and wait for approval via SMS or email

-

Once approved, receive your loan via GCash or bank

Finami’s application process typically takes less than 10 minutes from start to finish.

👤 Who Is Eligible to Borrow?

To apply for a Finami loan, you must:

-

Be a Filipino citizen

-

Be between 20 and 70 years old

-

Have a valid ID (UMID, driver’s license, passport, etc.)

-

Have an active phone number and email

-

Own a GCash account or bank account

-

Be employed, self-employed, or have consistent income

No payslips or employment certificates are required — Finami is friendly to freelancers and informal earners.

💰 Loan Terms at Finami

Finami provides flexible, small- to mid-sized loan amounts:

-

Loan Amount: PHP 1,000 to PHP 25,000

-

Loan Term: 30 to 120 days

-

Interest Rate: 0% for first-time borrowers (promotional), then from 12% to 36% annually

-

Processing Fee: Deducted from loan amount

-

Repayment: via GCash, bank deposit, or partner channels

-

Extension: May be available upon request

🧠 When Should You Use Finami?

Finami is a great choice if:

-

You need money urgently for rent, groceries, medical bills, or tuition

-

You don’t have access to a credit card or traditional bank loan

-

You’re a freelancer or self-employed worker

-

You want a loan with no payslip requirement

-

You prefer a mobile-friendly experience

Whether you’re bridging the gap between paychecks or facing a financial emergency, Finami helps you access money with low friction and high speed.

📈 Pros and Cons of Finami

✅ Pros:

-

100% online loan process

-

GCash-friendly

-

Fast and easy to apply

-

High approval rates

-

Low entry requirements

-

No collateral or guarantor needed

❌ Cons:

-

Small initial loan amount for new users

-

Interest rates can increase on repeat loans

-

Limited loan term options

-

Some users may receive reminders via SMS early

🤝 How Finami Compares to Other Loan Apps

Unlike platforms like Cashspace or Peroloan, which are loan aggregators that match you with third-party lenders, Finami is a direct lender. This means less waiting, fewer steps, and a more personal process.

Compared to Finbro, Finami offers similar speed and disbursement via GCash, but with slightly smaller loan amounts for first-time users. While Finbro provides loans up to PHP 50,000, Finami caps its range at PHP 25,000 — though it compensates with fewer document requirements and faster onboarding.

When compared to Cash-Express, Finami provides more flexible repayment terms (30–120 days vs. 7–30 days), making it a better fit for borrowers who need a bit more time to repay.

If you’re familiar with Kviku, Finami is equally friendly to freelancers and those without payslips. However, Finami has a simpler application process and doesn’t rely on foreign verification systems.

In short:

-

Choose Finami if you want speed, simplicity, and flexibility

-

Choose Finbro if you need higher loan amounts and are a returning borrower

-

Choose Cashspace or Peroloan if you want to compare many options before applying

-

Choose Cash-Express if you need ultra-short-term cash quickly

Finami is one of the most user-friendly online loan providers in the Philippines today. With quick processing, GCash support, and no heavy requirements, it’s perfect for borrowers looking to access fast cash without the headaches of traditional loans.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

Jared, 34, Taguig

I used Finami when I needed money for a medical emergency. Approval took about 15 minutes and funds landed in GCash an hour later.

Ellaine, 29, Quezon City

First loan was PHP 5,000 at 0% interest. Paid it off and now they offer me double. Very smooth experience.

Mark, 39, Davao

No paperwork, just 1 ID. I’m self-employed, and they still approved me without question.

Alvin, 42, Manila

Tried other apps but they asked for payslips. Finami didn’t. Got approved fast and repaid without issues.