Credify Philippines Review — Fast Online Loans for Filipinos Without Paperwork

Need to borrow money fast but don’t want to deal with paperwork, banks, or phone calls? Credify Philippines is a digital-first solution that makes it easy to apply for cash loans online. Whether you’re a student, freelancer, first-time borrower, or someone with no credit score, Credify offers a modern and inclusive approach to emergency lending.

In this article, we’ll break down what Credify offers, how it works, and how it compares to other loan apps in the Philippines.

💼 What Is Credify?

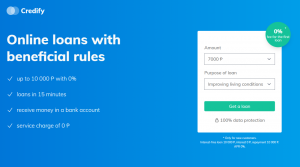

Credify.ph is a loan matching platform, also known as a loan aggregator. It does not issue loans directly, but instead connects you to licensed lending companies in the Philippines based on your personal profile and needs.

With just one application, Credify can help you discover multiple options for personal loans, making it easier to compare rates, terms, and requirements before applying.

✅ Key Features of Credify

-

✅ Fast application — just 3 minutes

-

✅ Get offers from multiple legit lenders

-

✅ No need to submit income documents

-

✅ Loans available even for bad credit

-

✅ GCash and bank transfer disbursement

-

✅ 24/7 availability — apply any time

-

✅ No service fee from Credify

If you’re tired of manually searching for trusted loan apps, Credify does the filtering and matchmaking for you.

📲 How to Apply for a Credify Loan

-

Go to credify.ph

-

Select your preferred loan amount and term

-

Fill out the short online form with your details

-

Submit and wait for the results

-

Get matched with lenders that suit your profile

-

Choose the offer you like and complete your loan application

-

Get disbursed via GCash, Maya, or direct bank transfer

The entire process is digital and mobile-friendly, no downloads or calls required.

👤 Who Can Use Credify?

Credify is available to:

-

Filipino citizens aged 18–70

-

Users with at least 1 valid government-issued ID

-

Anyone with a mobile number and email

-

Borrowers with GCash, Maya, or bank account

-

Self-employed, freelancers, informal workers

Credify is ideal for those who:

-

Don’t have payslips or bank statements

-

Have been rejected by traditional banks

-

Want to compare multiple loan offers instantly

-

Need cash loans today

💰 What Are the Loan Terms?

Since Credify is not a lender, terms depend on the lender you’re matched with. However, most partner offers include:

-

Loan Amount: PHP 1,000 – PHP 25,000

-

Loan Term: 30 – 180 days

-

Interest Rate: 0% for new borrowers, up to 36% APR

-

Processing Fee: Deducted upfront by lender

-

Approval Time: 10 – 30 minutes

-

Disbursement: GCash, Maya, or bank transfer

-

Repayment: via mobile wallets, banks, or payment centers

💡 When to Use Credify?

Credify is useful for:

-

Emergency financial needs

-

Rent, groceries, and bills

-

School payments or tuition

-

Business cash flow or resupply

-

First-time borrowers needing fast approval

-

People without stable job contracts

Instead of applying to 10 apps one by one, you apply once — and Credify shows you the best options instantly.

📉 Downsides and Limitations

-

You need to complete the loan application with the matched lender

-

Credify may show offers with different rates or fees

-

Not all matched offers are guaranteed

-

You may receive follow-up messages or SMS after applying

Still, the benefits of speed and multiple choices outweigh the minimal drawbacks — especially for first-timers.

🤝 How Credify Compares to Other Loan Platforms

Credify works much like Soscredit, Credy, and Cashspace — all of which are aggregators that match you to lenders. However, Credify’s process is especially streamlined for mobile users, and its interface is one of the cleanest available.

Compared to direct lenders like Finbro, Finapps, or Finmerkado, Credify offers more flexibility, especially for first-time applicants who want to compare terms before committing.

Unlike Cash-Express, which is focused on ultra-fast but short-term loans, Credify offers a broader range of durations and lenders. It’s more suited for people who want to choose the best deal, not just the fastest.

In summary:

-

Choose Credify to compare 3–5 pre-qualified offers in one place

-

Use Finbro or Finapps if you already know the lender you want

-

Try Cash-Express for 7–30 day loans only

-

Go with Credy or Peroloan if you want a similar experience with different partners

Credify is a fast, easy, and safe way to explore personal loan options in the Philippines. With just one application, you can see multiple offers, compare conditions, and make smart decisions — all from your phone.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

Ken, 27, Taguig

Got matched with 4 different lenders. Chose one and got PHP 6,000 same day.

Grace, 31, Quezon City

Didn’t have a payslip but still got approved. Just used my ID.

Jonas, 45, Cebu

Perfect for freelancers like me. Fast, no pressure, and legit.

Arlene, 22, Davao

Applied at 11 AM, money was in GCash before 3 PM. Very helpful platform.