Microloans

🧩 Can’t Get Approved? This Is Why We Built LoanAppsPH

Sometimes, you apply for a loan from one provider and get rejected. Then you try another app — and the same thing happens. The process becomes frustrating, slow, and unpredictable.

That’s exactly why LoanAppsPH was created.

Our goal is to make it easier for Filipinos to find legit, fast microloan options without wasting time on unreliable apps. We help you compare offers, check requirements, and choose lenders with the highest approval chances — all in one place.

No guesswork. No endless rejections. Just smart borrowing.

Microloans have become an essential financial solution for many Filipinos who need quick cash for emergencies, bills, small business needs, or personal expenses. Whether you’re employed, self-employed, or even unemployed, legit microloan apps in the Philippines now allow you to get fast approval — often without the hassle of documents or collateral.

In this guide, we’ll cover everything you need to know about microloans in the Philippines, how to apply online, what interest rates to expect, and how to choose the best legit lender.

📌 What Is a Microloan?

A microloan is a small, short-term loan typically offered by non-bank financial institutions (NBFIs), loan apps, or microfinance companies. These loans are designed to cover urgent or everyday financial needs and are ideal for borrowers who:

- Do not qualify for traditional bank loans

- Need funds within hours

- Cannot provide payslips or collateral

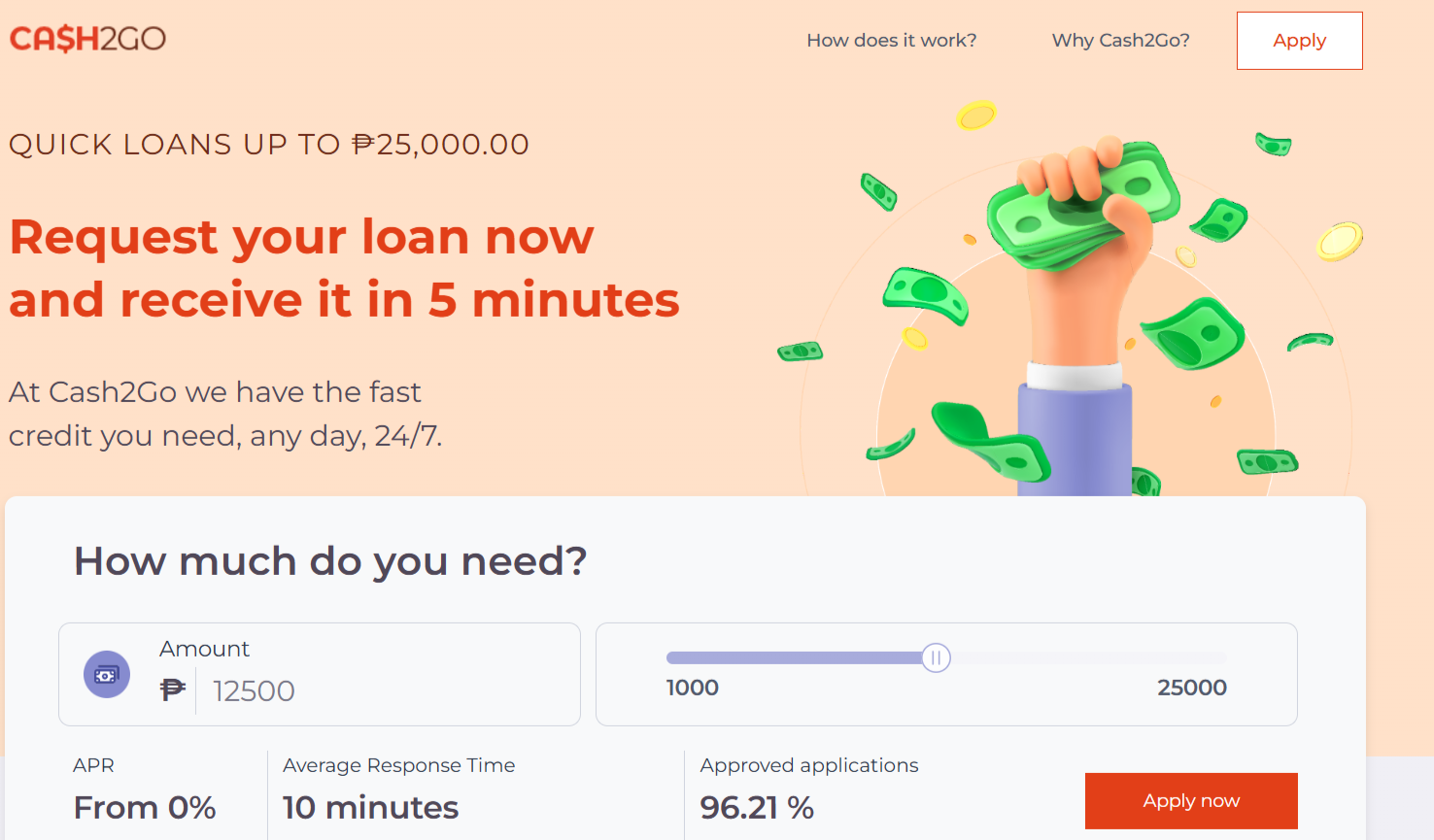

Microloans in the Philippines usually range from ₱1,000 to ₱25,000, with repayment terms between 7 and 180 days. Many legit loan apps now offer 0% interest on the first loan.

⚡ Top Benefits of Microloans in the Philippines

| Benefit | Description |

|---|---|

| ✅ Fast approval | Most apps offer approval within minutes |

| ✅ No collateral required | Loans are unsecured |

| ✅ Minimal documents | Only a valid ID is usually needed |

| ✅ 100% online process | Apply anytime, anywhere |

| ✅ First-time promos | 0% interest for new users |

| ✅ Flexible repayment terms | 7 to 180 days depending on provider |

🧾 How to Apply for a Microloan Online

Applying for a microloan in the Philippines is easier than ever:

- Choose a legit provider – like Digido, Tala, Finbro, or JuanHand

- Download the app or visit the website

- Register with your mobile number

- Submit valid ID and personal info

- Wait for instant approval

- Receive funds via GCash, bank transfer, or remittance

⏱ Average time from application to payout: 5–15 minutes

💳 How to Receive a Microloan in the Philippines

Most microloan apps in PH support multiple payout methods:

- ✅ GCash

- ✅ Maya

- ✅ Bank transfer (BDO, BPI, UnionBank, etc.)

- ✅ Remittance centers like M Lhuillier or Cebuana

- ✅ Cash pick-up (limited)

You can choose the method when submitting your loan application.

💡 Who Can Apply for a Microloan?

Microloan providers are more flexible than banks. You may qualify if:

- You’re at least 18 years old

- You have a valid government-issued ID

- You have a stable mobile number and access to GCash or a bank account

Some providers do not require payslips, certificates of employment, or a credit history.

📊 Typical Loan Terms and Interest Rates

| Parameter | Range |

|---|---|

| Loan amount | ₱1,000 – ₱25,000 |

| Repayment term | 7 to 180 days |

| Interest rate | 0.1% – 1.0% per day |

| APR | 36% to 365%+ |

| First-time promo | Often 0% for 7–30 days |

📌 Note: Always check the total repayment amount before accepting the loan.

✅ Best Legit Microloan Apps in the Philippines (2025)

Here are some of the top-rated loan apps that offer fast and safe microloans:

- Digido – up to ₱25,000, first loan at 0%, approval in 5 mins

- JuanHand – repeat borrowers get better rates

- Tala Philippines – great for low-credit users

- Finbro – high approval rate, even for freelancers

- Online Loans Pilipinas – fast payouts via GCash

- Cashalo – offers installment-based microloans

- UnaCash – offers shopping + cash loan hybrid

- MoneyCat – flexible terms for first-time borrowers

- PesoRedeeem – great for GCash users

- Binixo – useful for comparing offers instantly

🧠 Why Filipinos Prefer Microloan Apps Over Banks

| Microloan Apps | Banks |

|---|---|

| 5-minute application | 3–5 days processing |

| No documents required | Payslip, COE, ITR required |

| No collateral | May require property or co-maker |

| Works on mobile (GCash/PeraPadala) | Requires account or branch visit |

| 0% first loan (many apps) | Full interest from day one |

🔐 How to Know if a Microloan App is Legit?

Always check the following before applying:

- Is the company registered with the SEC?

- Does it have clear contact details on its website?

- Is the app listed on Google Play with good reviews?

- Are terms and fees transparent?

- Avoid apps that require excessive permissions or access to contacts/photos.

✅ LoanAppsPH only lists SEC-registered and verified loan providers.

🚫 Common Mistakes to Avoid

- ❌ Borrowing from unlicensed loan apps found on Facebook

- ❌ Ignoring the total repayment amount

- ❌ Giving access to personal contacts or private info

- ❌ Taking multiple microloans at once

- ❌ Missing payment deadlines — this damages your future approval chances

🧭 How to Choose the Best Microloan App?

When comparing microloans in the Philippines, look at:

- 🏦 Interest rate (daily or monthly)

- 📆 Repayment term flexibility

- 💰 First-time borrower perks

- 🚀 Payout speed

- 📱 App reviews & support

- 🔐 Legitimacy and licensing (SEC)

LoanAppsPH helps you compare all legit options side-by-side so you don’t fall for hidden fees or shady apps.

📚 Frequently Asked Questions (FAQ)

Is there a microloan with 0% interest in the Philippines?

Yes. Apps like Digido, Tala, and JuanHand offer 0% interest for first-time borrowers on short-term loans.

Can I get a microloan without proof of income?

Yes. Many apps only require a valid ID and mobile number. Proof of income is optional for most providers.

Do I need a GCash account?

While not required, having GCash makes payouts and repayments much easier. Most apps support GCash.

How fast can I get the money?

Some providers send the money within 5 minutes of approval — especially via GCash or bank transfer.

🔚 Conclusion: Microloans Are Now Easier Than Ever in the Philippines

Whether you need money for medical bills, school, rent, or daily expenses — microloans in the Philippines are a fast, flexible, and accessible option. Thanks to legit mobile loan apps, you no longer need to wait in line at a bank or fill out stacks of paperwork.

Compare offers now on LoanAppsPH, choose a provider, and receive your funds today — fast, easy, and safe.