MoneyCat Philippines — Trusted Loan App for Fast Online Cash Loans

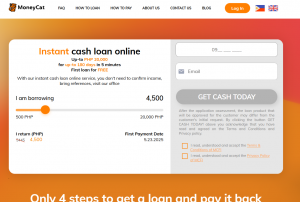

Are you urgently looking for a fast cash loan in the Philippines? Need to pay bills, cover emergency expenses, or bridge a budget gap before payday? MoneyCat Philippines is a legit, SEC-registered loan app that offers quick, simple, and fully online loans in the Philippines. No collateral. No long queues. No paperwork. Just fast approval and instant cash.

Whether you’re employed, self-employed, or even have bad credit, MoneyCat can be a go-to solution for those in urgent need of financial support.

💼 What is MoneyCat?

MoneyCat Financing Inc. is a legal online lending company in the Philippines, registered with the Securities and Exchange Commission (SEC) under Company Reg. No. CS201953073 and Certificate of Authority No. 1254. The company operates a loan app in the Philippines that focuses on short-term, digital lending to Filipinos seeking emergency loans, personal loans, or instant cash assistance.

The platform caters to Filipinos who don’t have access to traditional banking services or don’t have time for slow, paperwork-heavy processes. MoneyCat offers a 100% digital borrowing experience — everything from application to approval and disbursement is done online.

⚡ Why Choose MoneyCat for Online Loans in the Philippines?

There are many loan apps in the Philippines, but MoneyCat stands out for several reasons:

-

100% digital application — no need to visit any office

-

Loan approval in 30 minutes or less

-

Loan amounts up to PHP 20,000

-

0% interest for first-time borrowers

-

No collateral needed

-

Perfect for emergencies or urgent cash needs

-

Compatible with GCash, Maya, and bank transfers

-

Accepted even with no credit history or poor credit score

For borrowers looking for fast online loans in the Philippines, MoneyCat is a strong option, especially when time is of the essence.

🧾 Loan Terms and Conditions

| Feature | Description |

|---|---|

| Loan Amount | PHP 500 to PHP 20,000 |

| Loan Term | 90 to 180 days |

| Interest Rate | 0% for first loan; up to 11.9% monthly |

| Processing Time | Within 30 minutes |

| Disbursement | GCash, Maya, or bank account |

| Collateral Required | None |

| Eligibility Age | 22 to 60 years old |

Note: Always review updated terms on the official website before applying.

✅ Who is Eligible to Apply for a MoneyCat Loan?

MoneyCat is known as one of the easiest loan apps to get approved in the Philippines. Here are the basic requirements:

-

Filipino citizen

-

22 to 60 years old

-

Valid government-issued ID (UMID, Driver’s License, Passport, etc.)

-

Active mobile number and email

-

Personal bank account or GCash/Maya account

You don’t need a credit card, payslip, or ITR. In fact, many people use MoneyCat for loans without documents or loans with bad credit in the Philippines.

📝 How to Apply for a Loan via MoneyCat App

Applying for a loan through the MoneyCat app is fast, simple, and paperless. Here’s how:

-

Visit moneycat.ph or download the app on Google Play

-

Register using your mobile number

-

Fill out the application form with your basic info

-

Upload your valid ID

-

Wait for approval (usually within 15–30 minutes)

-

Receive the loan in your GCash, Maya, or bank account

First-time borrowers may receive a call from a MoneyCat agent for quick verification. After that, repeat loans are even faster.

🚀 How Fast is the Loan Approval Process?

One of MoneyCat’s biggest selling points is its instant loan approval process. Once you’ve uploaded your documents and submitted your form, their algorithm evaluates your application in minutes.

✔ Most loans are approved in 30 minutes or less

✔ Money is disbursed immediately after approval

✔ GCash or Maya users often receive money within the hour

💬 Use Cases: When MoneyCat Can Help

1. Emergency medical expenses

Life happens. Sometimes you need to pay for medicine, checkups, or minor operations fast.

2. Utility bills

Don’t wait for disconnection. MoneyCat can help you settle bills instantly.

3. Business capital

Need small funds to restock inventory or buy equipment? This loan app in the Philippines is perfect for micro-entrepreneurs.

4. Tuition or education needs

Bridge a school payment deadline with a quick cash loan.

5. Daily expenses

Sometimes you just need a small boost to get through the week — that’s where MoneyCat shines.

🔄 Repayment Options and Loan Extensions

Repaying your loan with MoneyCat is easy. You can pay through:

-

GCash

-

Maya

-

Online banking

-

Bank transfer

-

7-Eleven or Bayad Center

Late repayment leads to penalties and interest charges, so if you’re unable to repay on time, it’s best to contact MoneyCat to request a loan extension. Repeat borrowers often get access to higher loan limits and more flexible terms.

🛡️ Is MoneyCat Safe and Legit?

Absolutely. MoneyCat is a legal loan provider in the Philippines and is monitored by the SEC. Your personal data is encrypted and secured. Many borrowers trust MoneyCat as one of the legit online loans in the Philippines.

It is not a loan shark or fly-by-night lender. However, as with any financial service, read the fine print and understand your repayment obligations.

📈 Pros and Cons of Using MoneyCat Loan App

✔ Pros:

-

Very fast approval and disbursement

-

0% interest for new users

-

No collateral or guarantor required

-

Accepts first-time borrowers

-

Available nationwide in the Philippines

-

Flexible repayment methods

✖ Cons:

-

High interest for repeat loans

-

Short loan durations (not ideal for long-term borrowing)

-

Late payment penalties can add up quickly

🔍 MoneyCat vs Other Loan Apps in the Philippines

| Feature | MoneyCat | Finbro | UnaCash | Pesoloan |

|---|---|---|---|---|

| Approval Speed | ✅ Very fast | ✅ Fast | ⚠ Manual check | ✅ Fast |

| First Loan Interest | ✅ 0% | ✅ 0% | ❌ Regular rate | ✅ 0% |

| Disbursement | ✅ GCash/Bank | ✅ GCash/Bank | ✅ Bank only | ✅ GCash/Bank |

| Amount Range | Up to PHP 20K | Up to PHP 50K | Up to PHP 50K | Up to PHP 30K |

| Repeat Benefits | ✅ Yes | ✅ Yes | ⚠ Strict policy | ✅ Yes |

🟢 Final Thoughts — Should You Try MoneyCat?

If you’re looking for fast online loans in the Philippines, MoneyCat is a solid, legitimate choice for both first-time and repeat borrowers. It’s one of the few loan apps that offers 0% interest loans to new users, with a lightning-fast approval system and user-friendly platform.

It’s ideal for:

-

People without access to traditional bank loans

-

Freelancers and gig workers

-

Those who need emergency loans online in the Philippines

-

Users looking for GCash loan apps or loans with minimal paperwork

Just remember:

-

Always borrow responsibly

-

Repay on time to avoid penalties

-

Understand the full terms before confirming your loan

With high approval rates, a mobile-first experience, and rapid disbursement, MoneyCat continues to be one of the top loan apps in the Philippines in 2025.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

“I applied at 10:00 AM and had the cash in my GCash by 10:45 AM. This is the fastest loan app I’ve used.”

— Maricel, 29, Quezon City

“Perfect for emergencies. The app is simple, and they didn’t ask for too many documents.”

— Jonas, 34, Cebu

“MoneyCat helped me cover unexpected medical costs. I was surprised how easy it was to apply.”

— Alma, 38, Taguig

“As a freelancer, I’ve had trouble getting loans from traditional banks. MoneyCat didn’t discriminate.”

— Erwin, 41, Davao

“Just be sure to repay on time. The extension is possible but it costs more. Still better than borrowing from friends.”

— Liza, 26, Makati

“Highly recommended if you need fast cash without collateral. Will use again.”

— Neil, 32, Manila