Cash2GO Review — Fast Cash Loans Online in the Philippines

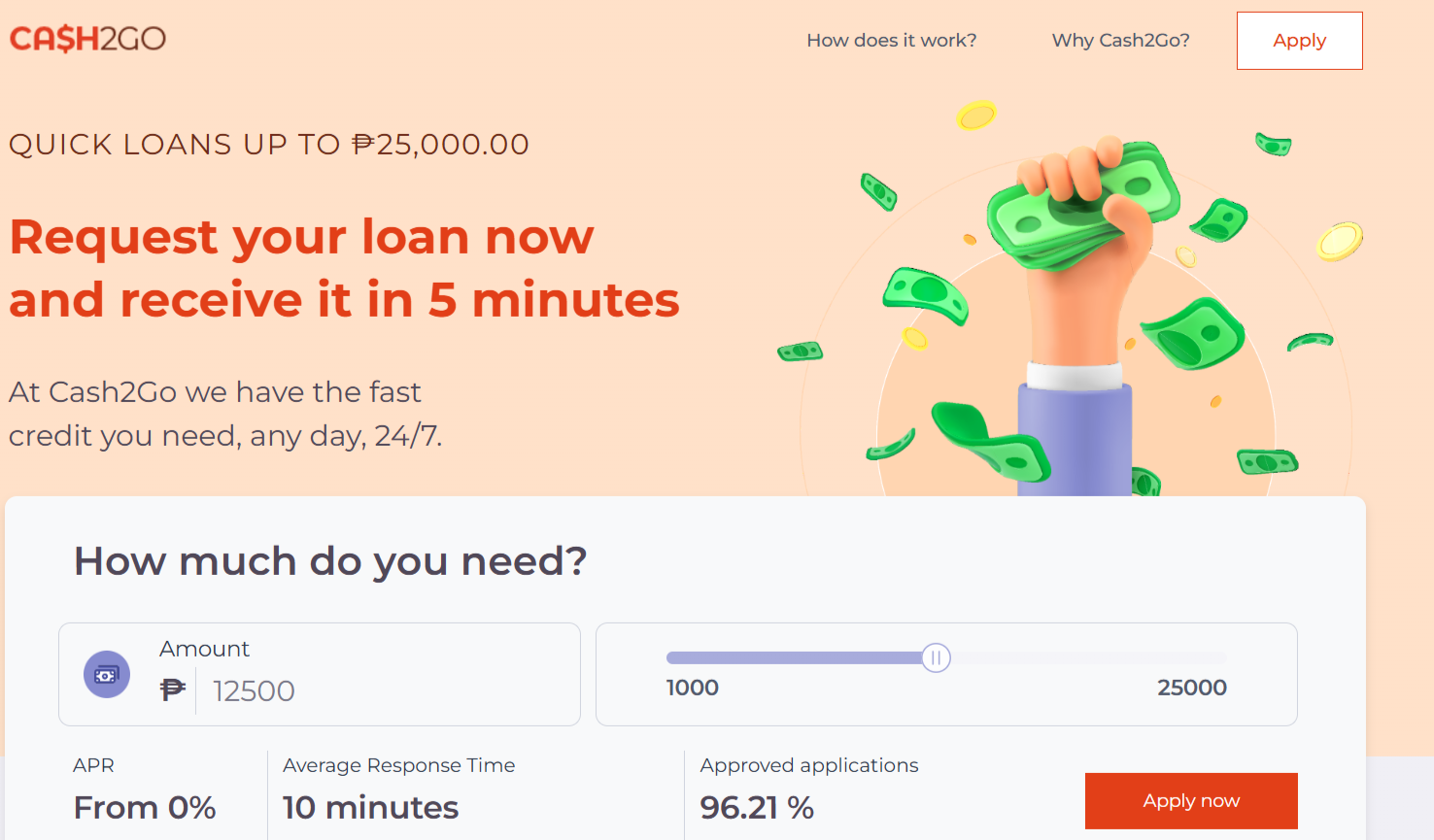

Need urgent cash? Cash2GO is one of the emerging microfinance platforms in the Philippines that offers quick and easy online loans to Filipinos in need of emergency funds. With a streamlined digital application process, minimal document requirements, and high approval rates, Cash2GO positions itself as a go-to option for short-term financial solutions.

💼 What is Cash2GO?

Cash2GO is a financial service provider in the Philippines specializing in instant online microloans. The platform is designed to help employed and self-employed individuals get access to quick funds without the hassle of visiting a physical office or submitting bulky paperwork.

Their service operates 100% online, making it ideal for people looking for fast loan approval, even with a limited credit history.

⚡ Key Features of Cash2GO

-

🕒 Instant approval in as fast as 15 minutes

-

💸 Loan amounts from PHP 1,000 to PHP 20,000

-

📲 Fully digital application process

-

📑 Minimal requirements

-

🔁 Loan renewal and repeat borrower benefits

-

👤 Available even for those with no credit history

✅ Requirements to Apply

To apply for a loan with Cash2GO, you typically need:

-

Valid government-issued ID (e.g., UMID, Driver’s License, Passport)

-

Active mobile number

-

Valid email address

-

Proof of income (optional for first-time borrowers)

📝 How to Apply for a Loan from Cash2GO

-

Visit the official website of Cash2GO

-

Register using your mobile number

-

Fill out your personal and financial details

-

Upload your ID and supporting documents

-

Wait for approval (usually within 15–30 minutes)

-

Get funds disbursed directly to your bank or e-wallet

💳 Loan Terms and Conditions

| Feature | Detail |

|---|---|

| Loan Amount | PHP 1,000 – PHP 20,000 |

| Interest Rate | Varies, typically 0.5% to 1.2% per day |

| Loan Term | 7 to 30 days (extendable) |

| Disbursement | Bank account or GCash |

| Processing Time | Within 1 hour after approval |

| Penalty for Late Payment | Yes, daily interest + late fee |

| Extension Option | Available with added interest |

📍 Why Choose Cash2GO?

-

Fast application & disbursement process

-

Ideal for first-time borrowers

-

Flexible loan terms

-

Transparent fee structure

-

No collateral or guarantor needed

❓ FAQ — Frequently Asked Questions

1. Is Cash2GO legit in the Philippines?

Yes, Cash2GO operates legally and complies with financial regulations.

2. Can I apply even if I have a bad credit history?

Yes, the platform accepts borrowers with limited or poor credit histories.

3. How fast can I get the loan?

Loan disbursement typically happens within an hour after approval.

4. What if I can’t repay on time?

Late payment penalties may apply. It’s advisable to repay on time or request an extension.

🔚 Final Thoughts

Cash2GO is a reliable microfinance option for Filipinos seeking fast and easy online loans. Whether you’re dealing with unexpected bills, urgent expenses, or just need to bridge a financial gap until payday, this platform offers a practical solution with minimal friction.

It’s suitable for first-time borrowers and those seeking repeat flexibility. Always borrow responsibly and only the amount you truly need.

Terms and Rates

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

“I needed money urgently for a medical emergency. Cash2GO approved my loan in under 30 minutes!”

— Mark, 32, Quezon City

“This is my second time borrowing. The process was even faster than before!”

— Rhea, 28, Pasig

“The interface is simple and user-friendly. A great experience overall.”

— Joseph, 45, Davao City

“They really saved me during a tight budget week. Thank you, Cash2GO.”

— Mina, 23, Taguig