GCash Debit Mastercard Review Philippines: Convenient Digital Banking and Payments

Trusted Loan Apps

About GCash Debit Mastercard

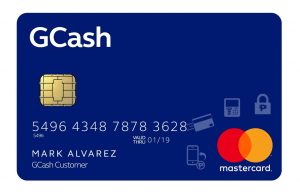

GCash Debit Mastercard is one of the most popular debit cards in the Philippines, linked directly to the widely used GCash mobile wallet. This card offers Filipinos a seamless way to access their funds, make online and offline purchases, and enjoy cashless transactions with the convenience of a Mastercard. With millions of users, GCash has revolutionized financial inclusion and digital payments across the country.

GCash is operated by Mynt (Globe Fintech Innovations, Inc.) and partners with Mastercard to provide a secure, globally accepted debit card. The card allows users to convert their GCash balance into physical card spending power without needing a traditional bank account.

Key Features and Benefits

Easy Access to Funds

-

Directly linked to your GCash wallet balance.

-

No need for a traditional bank account to get the card.

-

Spend anywhere Mastercard is accepted worldwide — stores, restaurants, online merchants.

Cash Withdrawals and Transfers

-

Withdraw cash at ATMs displaying the Mastercard logo.

-

Transfer money instantly between GCash users or to bank accounts.

-

Load funds via multiple channels including bank transfer, over-the-counter, and partner outlets.

Security and Convenience

-

Chip-enabled for enhanced security.

-

Control card usage and manage transactions through the GCash app.

-

Ability to lock/unlock card instantly via app in case of loss or theft.

-

Real-time notifications for transactions and spending alerts.

No Minimum Balance Requirement

-

Unlike traditional bank debit cards, GCash Debit Mastercard requires no minimum balance.

-

No monthly fees or maintenance charges.

Rewards and Promotions

-

Access exclusive discounts and cashback offers via GCash partner merchants.

-

Participate in occasional promos and raffles for cardholders.

How to Get a GCash Debit Mastercard

Step 1: Register for a GCash Wallet

-

Download the GCash app from Google Play Store or Apple App Store.

-

Register using your mobile number and verify your account.

Step 2: Verify Your Account

-

Complete KYC (Know Your Customer) process by submitting valid ID and a selfie.

-

Verification usually completes within 24 to 48 hours.

Step 3: Order Your GCash Debit Mastercard

-

Once verified, order your physical GCash Debit Mastercard via the app.

-

Delivery is typically within 7-10 business days nationwide.

Step 4: Activate and Use Your Card

-

Activate the card in the GCash app.

-

Link it to your wallet balance to start spending immediately.

Eligibility and Requirements

-

Must be a registered GCash user with verified account status.

-

Filipino citizen or resident with valid government-issued ID.

-

Mobile phone with internet access to manage account and card.

Advantages of GCash Debit Mastercard

-

Highly convenient for cashless payments without a bank account.

-

Widely accepted nationwide and internationally.

-

Enables financial inclusion for unbanked and underbanked Filipinos.

-

Real-time spending control and security features via app.

-

No hidden fees or minimum balance requirements.

Potential Drawbacks

-

Physical card delivery may take up to two weeks depending on location.

-

ATM withdrawal fees may apply depending on the ATM operator.

-

Limits on daily transaction and withdrawal amounts for security.

Tips for Maximizing Your GCash Debit Mastercard

-

Always monitor your transactions using the GCash app.

-

Take advantage of partner promos and cashback offers.

-

Keep your card information secure and report lost cards immediately.

-

Use the app’s lock/unlock feature when not using the card to prevent unauthorized use.

-

Set spending alerts for better budget control.

Frequently Asked Questions (FAQ)

Q: How long does it take to get my GCash Debit Mastercard?

A: Delivery usually takes 7 to 10 business days after ordering through the app.

Q: Can I use the card for online purchases?

A: Yes, it works anywhere Mastercard is accepted online or offline.

Q: Are there fees associated with the card?

A: There are no monthly fees, but ATM withdrawal fees may apply.

Q: How do I reload my GCash wallet?

A: You can reload via bank transfer, over-the-counter partners, or remittance centers.

Q: What if my card is lost or stolen?

A: You can immediately lock your card through the GCash app and contact support.

Conclusion

The GCash Debit Mastercard is an excellent financial tool for Filipinos seeking a flexible, secure, and widely accepted debit card without the need for a traditional bank account. It empowers users to perform cashless transactions conveniently, manage their money digitally, and participate in the growing cashless economy of the Philippines. Whether for everyday shopping, bill payments, or ATM withdrawals, GCash Debit Mastercard offers unparalleled convenience and accessibility.

Terms and Fees

Popular Loan Providers

Credify 0%

Instant approval for new users

Credy Popular

Flexible personal loans online

Finami

Cash loans for emergencies 24/7

Peroloan

Quick loans with no paperwork

Crezu

Compare loan offers in seconds

Mazilla

Best rates for fast cash loans

LoanOnline

Get approved in 5 minutes

Finmerkado

Loans for any financial goal

Soscredit

Urgent loans up to PHP 25,000

PesoRedee

Small loans without ID required

Cash2GO

Simple and fast online loans

Binixo

24/7 loan app for emergencies

The card is very convenient for everyday use, but sometimes ATM fees can be a bit high.

— Jasmine, Manila

I like the integration with the GCash app, although delivery took longer than expected.

— Carlo, Cebu

It’s a good option for those without a traditional bank account, but spending limits can be restrictive.

— Maria, Davao

Customer support is helpful but can be slow during peak times.

— Leo, Quezon City